Small businesses have a lot to think about when it comes to protecting and securing their financial future, and the best accounting apps for small business should be part of that consideration. The accounting software you use matters, and it can make a big difference to your productivity.

Your company deserves the right app for your needs, whether you’re just getting started or you’ve already been in operation for a long time.

But how do you know what to choose, and how can you find the app that will provide you with a quality, affordable experience while giving you all the help and support you desire? Is there more than one software option or suite of products that would be best for your specific needs?

Fortunately, you’ve come to the right place for that information. We have some recommendations on the best accounting apps, so you can choose one that works for your small business.

Top Recommendation: Xero Accounting Software

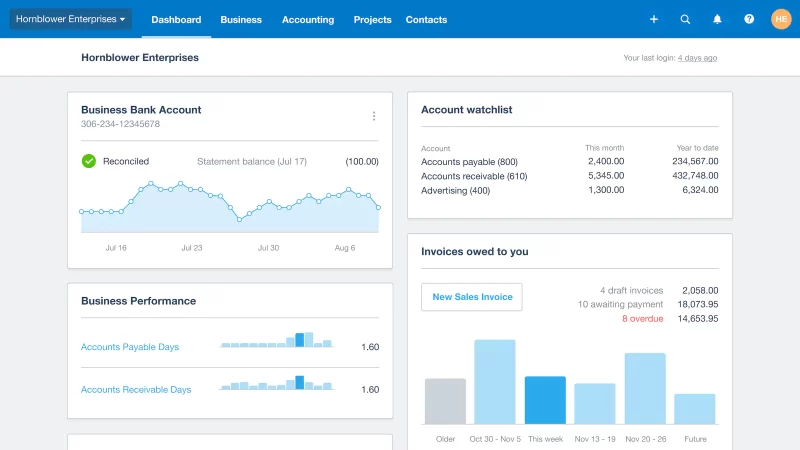

While there are plenty of accounting software options, Xero is our top pick for the best small business accounting app. That’s because Xero features quality and value that can save you significant amounts of time while preventing unnecessary stress. Leveraging modern software is an excellent way to get more done and protect your small business from costly financial problems.

Having everything in one place also makes it easier for an accountant to go over your information and prepare any needed documents. That can increase your peace of mind and, on a more practical note, reduce the risk of financial errors that could cause trouble for your small business.

Features of Xero

The features of Xero include options for payroll, data entry, and reporting along with the ability to reconcile bank statements and efficiently send invoices.

You can claim inventory and track projects through this app, too. It gives you convenient ways to accomplish everything in one place. Since it does so much, it’s no wonder that companies appreciate its features and choose it for their accounting needs.

You can get the benefits of this great app by using it for your company or choosing an accountant who uses it. Integrating it with someone who handles your company’s finances is a great way to make that part of your business run as smoothly as possible.

When you choose Xero for your small business, you can expect:

-

- Fast data entry, so you can get back to your day

-

- Single-touch Xero payroll to make sure payments go smoothly

-

- BAS reporting to keep track of where you are

-

- The ability to send invoices right from the software

-

- Up-to-date financials through bank reconciliation

-

- Project and inventory tracking for updated details

-

- The ability to pay bills and accept payments

Having these features in one place makes it far less difficult to get things done in your small business. From payroll options to the many ways bookkeeping can make your financial life easier, you don’t want to miss out on everything this great software offers.

By working with an accountant who uses Xero integration, you can also feel confident that everything you’re tracking will be stored and compiled in the same place for maximum convenience.

To make tracking even easier for everyone involved, you could have your employees use the expenses app that comes with this software. Whether it’s just you and a couple of employees or you have a small business with more than a dozen workers, the app makes tracking simple and allows everything to be integrated in a single place.

Keeping track of expenses isn’t always easy for a growing business, but the app makes it faster and more convenient to quickly track them and move on to the next task.

Be sure to consider add-ons as well. There are many ways to integrate other software and apps with Xero, so you can accomplish even more without the need to manually transfer information between separate programs.

You don’t have to settle for less or use a confusing tangle of programs and apps that don’t work well together. Instead, you can just use all the features and integration options of one app to help your business run more smoothly.

At MYCPartners, we are a certified Xero Gold partner, and we can help you and your small business reach your goals through Xero integration that provides the support you need.

We care about building relationships with our clients and keeping things simple in order to reduce stress for everyone involved. Some clients need more guidance than others, and we’re committed to helping your business grow while providing you with the type and level of help you desire.

Other Timesaving Bookkeeping Apps

If you’re considering a Hubdoc vs. Xero comparison, or you’re not sure about options like Driversnote and Invoice2go, it’s important to find out about these solutions before you make a definitive choice for your small business. The right combination can be even more powerful in helping your company succeed.

Here’s what you need to know about some great options for timesaving bookkeeping apps, many of which can be integrated with Xero.

Hubdoc

Hubdoc integration is possible, which makes the Hubdoc app desirable to use as one of the Xero add-ons or high-quality bookkeeping options.

You can use this app to import all of your small business’ financial documents, so you’ll have your bills and receipts in the same place. This type of integration is very important when you’re looking for a quality accounting app for your business.

Trying to transfer information from receipts and bills manually is a recipe for user error and all the problems that can create. When you have integration, you don’t need to worry about performing manual transfers or risking any errors.

You can also use Hubdoc to forward invoices right from your inbox, take a snapshot and send paperwork, and upload directly from your desktop. It’s easy, quick, and convenient, allowing you to get more done faster and feel secure about your financial information, too.

Invoice2go

![]()

Invoice2go is another option when you’re looking for a small business accounting app. If you need a great way to quickly and conveniently send invoices, it ranks among the best. You can optimize cashflow for your business and get paid more easily when you have multiple payment options, expense management, and other features all in one place.

While you might love what you do, getting paid is an important part of it all. Making sure you have strong invoicing abilities can boost the likelihood of faster payments, allowing you to keep your company advancing and ensuring that your small business’ needs are met.

Fortunately, Invoice2go also integrates with Xero. That means you can use them both together with ease and send invoices without worry. Professional invoices and great customer communication are big advantages of this software. Because you can integrate it so conveniently, it will be easier for your accountant to process information and help you with your small business financials.

Driversnote

If you have any employees who travel as part of their jobs and need to log trips, Driversnote is a useful app. It offers ATO-compliant vehicle logs, and users only need to bring their smartphones while traveling. More than one million people trust this software to track their trips, and motion detection automatically activates tracking even when the app remains closed.

Automatic tracking is really convenient, and if something doesn’t get tracked, it’s easy to manually enter trip details at a later date. Trips can be categorized to separate business travel from anything personal, too. You don’t have to worry about accidentally claiming trips that aren’t related to your small business.

The Bottom Line on the Best Accounting App for Small Business

The bottom line is that Xero is hands-down the best choice for a small business accounting app. Whether you’re using it or you have an accountant who does so, the software gives your company an edge when it comes to making sure financial information is accurately tracked in one place.

But there’s more to the story in that apps like Invoice2go and Hubdoc can be integrated into Xero and used together. Not only does that make it easier for small companies that already use one or more of these apps, but it gives new businesses a better idea of what they can use and integrate. This allows them to choose the most beneficial apps that they like best for each purpose.

Ready for a free consultation on how we can help streamline your bookkeeping and accounting processes through technology? Give us a call today and let us get you the information you need to make a knowledgeable decision for your small business.

To find out more about our accounting services, click here.